News

2024/11/08

GTIE Impact Startup Study Session was held.

A study session was held on October 31, 2012 at a conference room in the Steel Building to learn the basics and recent trends of “impact startups” and related ecosystems, which are both solution-oriented and sustainable growth-oriented and have a positive impact on society, with people from academia who support entrepreneurship and active investors. The meeting was held on October 31 at a conference room in the Steel Building.

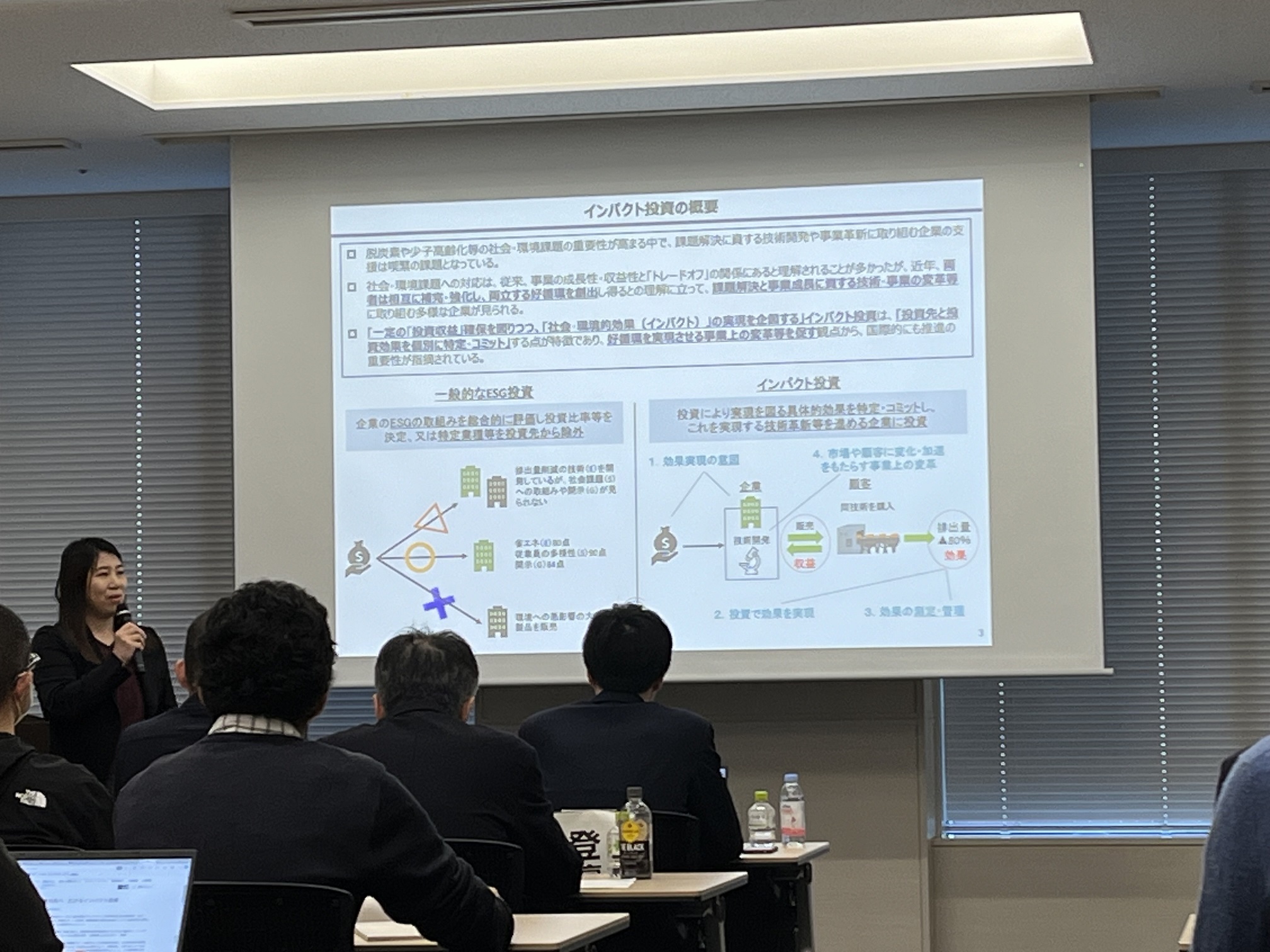

First, Ms. Ayako Hasebe, Assistant Director of the Sustainable Finance Promotion Office, Policy Planning Division, Policy Planning Bureau, Financial Services Agency, representing the government side, gave a presentation titled “Efforts to Promote Impact Investment,” covering topics such as the current concept and reality of impact investment and the existence of the “Impact Consortium” to promote understanding and collaboration among stakeholders. The “Impact Consortium” exists to promote understanding and collaboration among stakeholders.

He emphasized that one of the characteristics of impact investment, which is often misunderstood as a type of donation, is that it brings change and increased value to markets and customers. He also asked the audience about the difference between impact investment and ESG investment. He explained that the main difference between ESG investment and impact investment is that ESG investment mainly involves risk assessment checks, while impact investment focuses on results in terms of social change, and is also measured. He also explained that the Impact Consortium was established to promote the spread of impact investing and to facilitate collaboration among stakeholders, rather than to establish some kind of standard.

Next, Mr. Yuya Kato, General Manager of the Social Innovation Foundation (SIIF), which is engaged in activities aimed at building an ecosystem for impact investment from the standpoint of public-private cooperation, gave a presentation entitled “Impact Investment: Efforts for Dissemination and Practice,” in which he explained the current status of impact investment and its promotion, issues being addressed, and the status of studies toward standardization. He provided information on the current status and promotion of impact investment, issues being addressed, and the status of studies for standardization, using case examples.

He explained the origin of impact investment in Europe and the U.S., and the current status of progress from impact investment to the concept of impact economy. A participant asked which is more sought after in impact investment, the economic return or the impact of the startup? He responded that the priority in impact investment depends on the thinking of funds and LP investors, and that a cycle may emerge in the future whereby social entrepreneurship startups go public and the profits from the listing are used for philanthropic activities. The latest study on the concept of indicators to be used in impact investment was also shared, and expectations for the future were expressed regarding the significance of startups that utilize deep tech from universities being evaluated as impact startups.

Finally, Mr. Yuki Nakanishi, Impact Analyst at Keio Innovation Initiative (KII), who has made clear the promotion of impact investment in the No. 3 fund, provided information on KII’s investment approach and mission statement, including previous funds, and the vision of what KII aims to achieve through impact investment. Impact Investment” and the vision that KII aims to achieve through impact investment.

Although there is a certain amount of task load between investors and entrepreneurs when making impact investments, it is useful for better communication and due diligence, and understanding the logic model of impact investment provides suggestions for evaluation from the perspective of wellbeing and learning from the beneficiary’s viewpoint. He commented on the benefits that entrepreneurs can gain from understanding the logic model for impact investing, including the implications for evaluation in terms of wellbeing and learning from the beneficiary perspective.

GTIE believes that in order for impact startups not to be a transient boom, and for the future to see the emergence of companies that both grow in business and solve social issues, it is important that startups from deep tech in academia be evaluated as impact startups, and that the research and human resources related to impact startups be given the opportunity to work with the entrepreneurs. We believe it is important for academia to conduct more research and human resource development related to impact startups. In the future, we plan to hold workshops where startups aiming to become impact startups can practice IMM, as well as events where all parties concerned can get together. Details will be announced on the GTIE website.